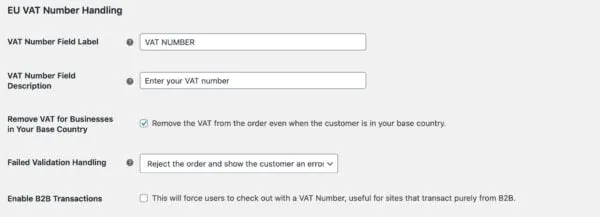

WooCommerce EU VAT Number Nulled allows you to eliminate VAT charges at the point of sale for qualifying EU enterprises.

- Allow certain businesses to bypass VAT (Value Added Tax) obligations;

- Gather and confirm customer location during B2C sales;

- Comply with EU tax regulations for digital products;

- Gather and authenticate EU VAT numbers during the checkout process;

This plugin equips your checkout page with a dedicated field to collect and verify a customer’s EU VAT Nulled number. If they provide a valid VAT number, your store will not impose VAT on their purchase.

Changelog

Version 2.9.9 Released on 2024-11-04

- Addressed a VAT charging issue when the base country is France and the buyer’s location is Monaco.

- Ensured accurate VAT calculations in the admin panel for virtual orders when tax assessments and VAT verification depend on the shipping address.

Version 2.9.8 Released on 2024-10-14

- Avoided unnecessary SOAP requests when the VAT number is incomplete.

- Confirmed that the VAT Number tab functions as an endpoint URL.

- Updated WooCommerce “tested up to” version to 9.4.

- Raised the minimum supported WooCommerce version to 9.2.

- Increased the minimum supported WordPress version to 6.5.